Conservative Ballot Measure Aims to Cut Nearly a Billion Dollars from Washington Schools

All to make a few thousand rich people just a little bit richer

A Trump donor just spent big to get a tax cut for the very rich on the November ballot in Washington State. If it passes, K-12 schools will lose about $900 million dollars.

Meanwhile, districts like Seattle Public Schools and others around the state are facing budget deficits and school closures, even before this initiative.

The motivation for taking money from children’s education? Beside conservative animus toward public schools, the school funds are raised through a modest tax on extreme capital gains. Apparently, the priority is lining the pockets of a few thousand multi-millionaires, not educating millions of children.

This tax is the kind almost none of us will ever pay. Even those earning in the top 1% are pretty unlikely to pay a penny.

This is because even for high earners, there are tons of ways to avoid or minimize the tax. Most who pay any significant amount will only have to do so because they make stratospheric amounts of money, year after year.

(If you want to know how the tax works and who pays for it, see the appendix below).

Which is why last year only 3765 filers paid this tax in all of Washington State. That’s a little more than one out of every one thousand households.

The average payer had capital gains of $3.6M in 2023. Remember that’s the profit they made on the increased value of something like the stock they happened to sell last year. For that, they paid an average of $236k in taxes each.

The Ugliest Kind of Redistribution

In other words, if this measure passes, we will redistribute nearly a billion dollars from K-12 education to people who make so much money that they can’t cram most of their annual profits-from-asset-sales under the $250,000 annual minimum.

Pop Economics

Many will claim we need to repeal this tax because it will otherwise somehow hurt our economy. They will tell you that rich people won’t invest, or they will move, or won’t start companies here.

But real economists have shown that this kind of folksy economic theory is wrong in the real world. As I frequently remind my readers, decades of economics research has shown that lower taxes on the rich do not grow the economy and instead only increase inequality.

Neither do variations in tax rates across states drive millionaires to migrate, as local tech billionaire Nick Hanauer recently reminded us. And they have “no detectable impact on startup activity,” according to the Federal Reserve. To top it off, this tax is unusually well designed to avoid any negative impact on the economy. (See appendix below for further discussion).

The Bizarre Fight to Keep Taxes Regressive in Washington.

Some of my readers will be old enough to remember to Herman Cain, a 2012 Republican “Tea Party” candidate. He campaigned on his “9-9-9” plan, which got the nation talking about the concept of flat taxes. But his plan was considered too radical and, frankly, a bit kooky, even for Republicans voting in a primary.

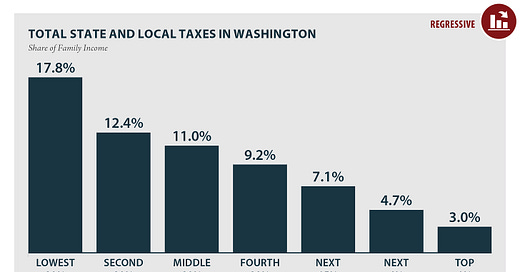

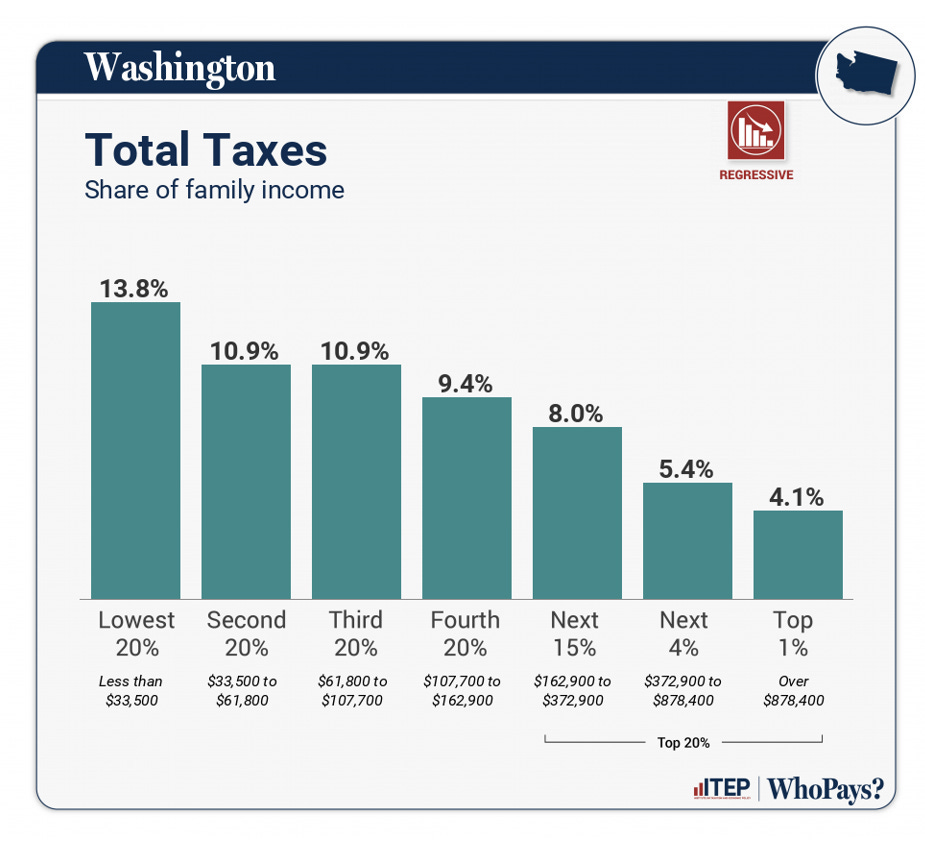

And yet here in Washington State, our taxes are even worse than flat! They are what wonky types call “regressive” where the poor pay a larger share of their income in taxes than the rich. In fact, until recently, Washington State taxes were the most regressive in the country.

Yes, you heard me correctly, in Washington State the poor paid a higher percentage of their income in taxes relative to the rich than in any other state, red or blue.

Here is the 2018 data.

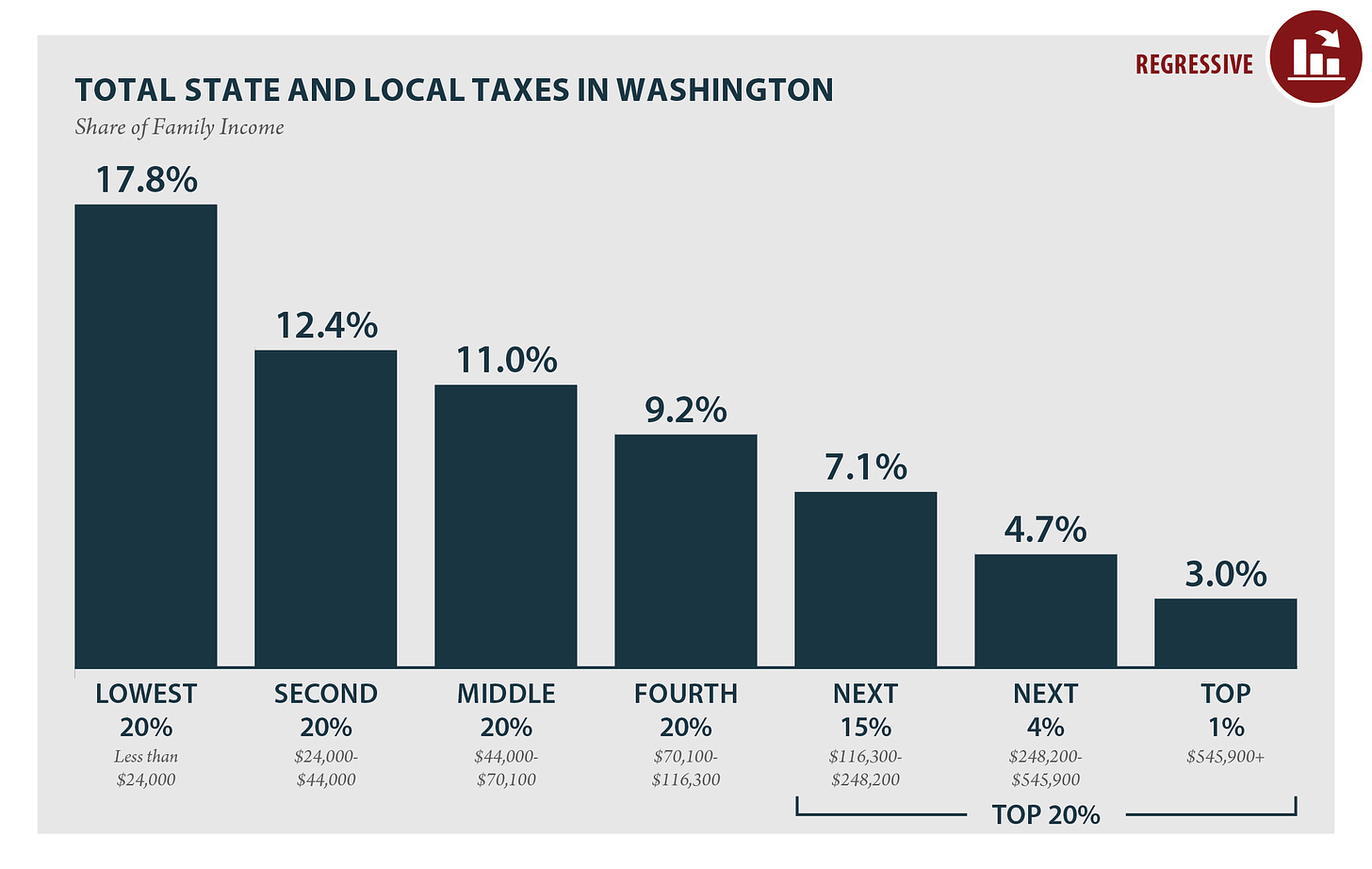

But in recent years Washington finally made two tweaks to our tax code, with a tax credit for working families, and the modest tax on extreme capital gains I discussed above. In Seattle, we also passed JumpStart, a tiny tax on high incomes in Seattle—with an exception for incomes at small businesses.

With these changes, we have improved to second-worst in the nation, just behind Florida. Here is the 2024 data.

We are still much harder on the poor than even something as radical as a flat income tax.

But conservatives ideologues insist out taxes should be even more regressive.

As an example, Seattle City Council leader Sara Nelson opposes that very small tax on high incomes at big businesses in Seattle. And now her “spending is the problem” allies in Republican party are chasing a similar agenda statewide with this initiative to repeal the tax on extreme capital gains.

They are dumping millions into this effort, and will likely spend it on bamboozling voters into thinking being the 49th most regressive tax state is too progressive. (They will say it differently, of course).

Please vote on this repeal and make sure your friends all understand why.

Appendix: A Deeper Look at the Tax on Extreme Capital Gains

The Mechanics

The tax is 7% on annual capital gains over $250,000. There is no tax on the first $250,000, each year. So if you have a $250,001 capital gain, you pay only seven cents.

There are tons of ways to avoid or minimize the tax—if you make your money from selling your house, or the money is in an IRA or 401k, you don’t pay anything. If you break up the stock sales over multiple years, and you fall below $250,000 in a given year, you pay nothing. And even if you go over $250,000, the first $250,000 each year is untaxed.

So most of the people who pay any notable amount of money have to do so because, after all these strategies, they still blow past the $250k threshold. Which is why last year only 3765 filers paid in Washington State.

Likely Economic Effect

As mentioned above, decades of economics research shows that economic activity (such whether people invest or work) and geographic mobility (whether people move) are pretty inelastic (unresponsive) in the face of variances in local tax levels between US jurisdictions. This is true for rich people too. This particular tax is more modest than taxes in many successful US jurisdictions with progressive taxes. It also affects very few people, and with the large deduction, reduces the portion of income that is subject to taxation. In addition, due to the nature of capital gains, many of the people who pay the tax are unlikely to pay it year after year, even further reducing any incentives to take their economic activity elsewhere.

And given that geographic mobility is particularly inelastic because of things like family, community, schools, jobs or spouse’s jobs, or the location of an owned business—the slice of the electorate that might still somehow be motivated to move is vanishingly small.

Remember that the research shows similar taxes to have no net effect.

This is probably because if there are any negative effects, they are offset by positive effects. In other words, the investments also yield social and economic returns, like better schools and a more prepared workforce, some of which attract people (including wealthy ones) to migrate here.

*First Chart and Analysis from “Who Pays,” the Institute on Taxation and Economic Policy (ITEP), 6th Edition.

**Second Chart and Analysis from “Who Pays” the Institute on Taxation and Economic Policy (ITEP), 7th Edition.

Sara Nelson is a straight up Republican. I hope the voters see this and the negative consequences she brings, and change their vote in 2025.